Comprehensive Guide to Buying and Understanding Travel Insurance

Introduction: Why Travel Insurance Matters

Travel insurance serves as a critical safety net for travelers, offering financial protection against a broad array of unexpected events such as accidents, illness, missed flights, canceled tours, lost baggage, theft, and even acts of terrorism. Whether you’re planning a single vacation or traveling frequently for business, understanding how travel insurance works and how to buy the right policy can shield you from significant financial loss and stress [2] .

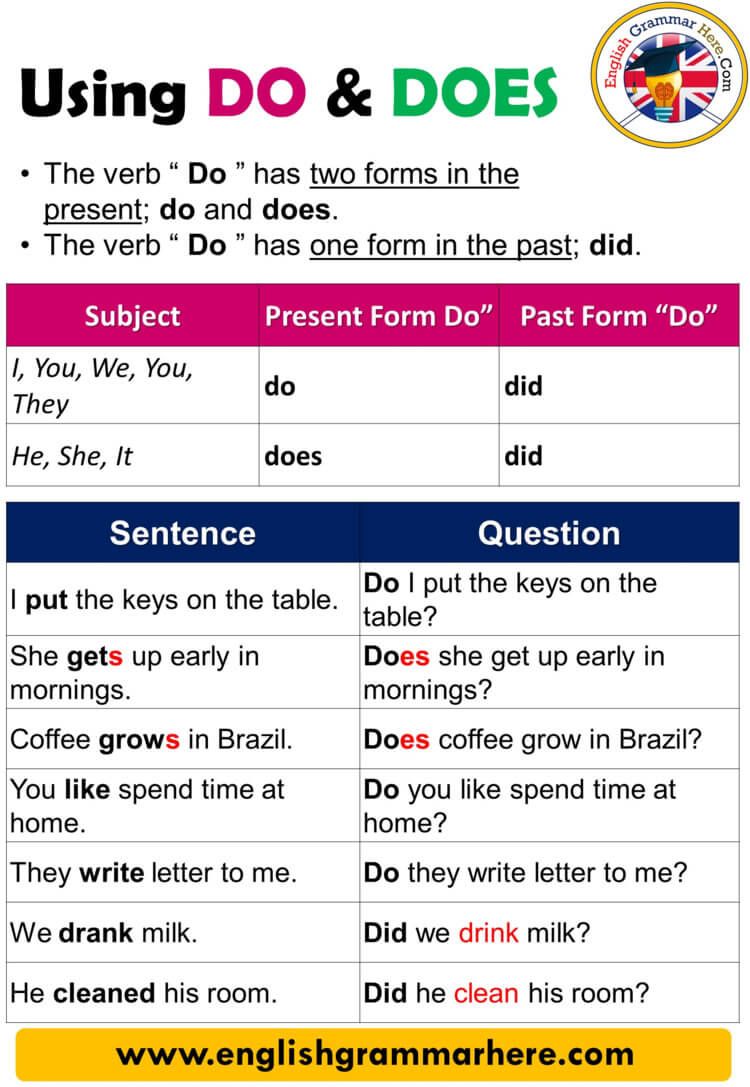

How Does Travel Insurance Work?

Travel insurance operates by covering specific risks and expenses that could arise during your trip. The menu of coverage typically includes:

- Trip Cancellation and Interruption: Reimburses prepaid, nonrefundable expenses if you must cancel or cut short your trip due to covered reasons like illness, injury, or unforeseen emergencies.

- Medical Coverage: Pays for emergency healthcare costs incurred while traveling, especially important if your regular health insurance doesn’t extend abroad.

- Evacuation Insurance: Covers costs of emergency medical evacuation, such as air ambulance services if you fall seriously ill far from medical facilities.

- Baggage Insurance: Compensates for lost, stolen, or damaged luggage and personal belongings.

- Flight Insurance: Offers protection for missed connections or delays.

Most travel insurance plans are packaged, meaning you’ll purchase a policy that includes several types of coverage. Comprehensive policies can be primary (paying first, regardless of your other insurance) or supplemental (covering gaps in existing plans) [2] , [3] .

Coverage limits, exclusions, and deductibles vary widely. Carefully read the policy documentation to understand what’s covered, what isn’t, and applicable limits before purchasing [4] .

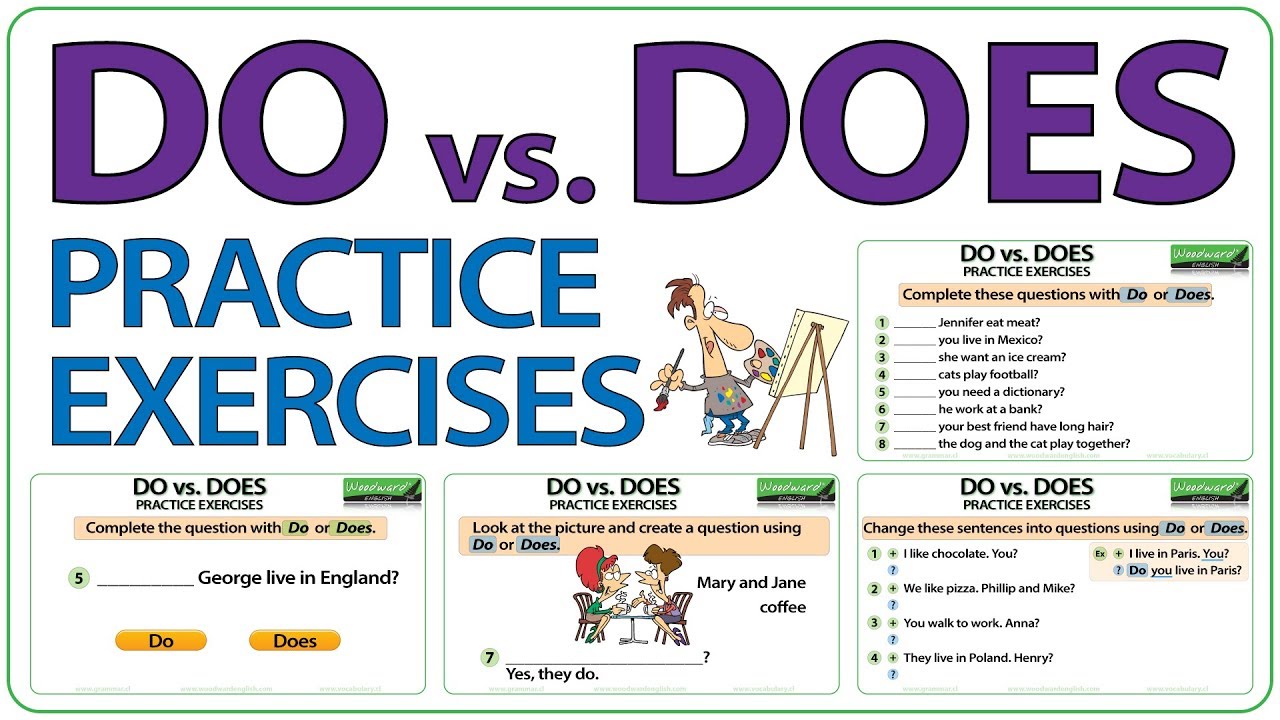

Do You Need Travel Insurance?

The need for travel insurance depends on your personal risk tolerance, destination, trip cost, and existing coverage. Consider these factors:

- Financial Risk: Can you afford to lose the nonrefundable costs of your trip due to cancellation or interruption? If not, insurance is wise [2] .

- Health Coverage: Does your health insurance cover you abroad? Many U.S. policies do not. If traveling internationally, medical and evacuation coverage is essential.

- Trip Complexity: More expensive, complex, or lengthy trips (such as cruises, tours, or multi-city journeys) increase the risk of financial loss due to cancellations or mishaps.

- Destination Risks: Traveling to areas prone to natural disasters, political unrest, or limited healthcare access may require additional coverage.

For budget travelers or domestic trips, you may already have sufficient protection through existing homeowners, renters, or credit card insurance. Always review your current policies before purchasing additional coverage [1] , [4] .

How to Buy Travel Insurance: Step-by-Step Guidance

Purchasing travel insurance can be done online, through travel agents, or directly from insurers. Follow these steps for a seamless experience:

- Assess Your Coverage Needs: List your risks (e.g., cancellation, medical emergency, expensive gear). Check your existing insurance policies, including credit cards and homeowners/renters policies, for travel-related benefits.

- Compare Plans and Providers: Use travel insurance comparison sites to get quotes from multiple carriers. Key players include companies like Travelex and Travel Guard, both of which offer customizable packages and online purchasing [5] .

- Choose Coverage Type: Decide between single-trip policies (for one-off vacations) or annual/multi-trip plans if you travel frequently. Multi-trip policies may offer cost savings but sometimes cap cancellation coverage [1] .

- Get a Quote: Premiums are usually based on trip cost and traveler age. Typical policies cost about 4-10% of your total trip price, but may be higher for older travelers or those seeking more comprehensive coverage [4] . Some insurers, like Allianz, provide a range of plans for different budgets and needs [3] .

- Read the Fine Print: Scrutinize policy exclusions, limits, and claim procedures. Ask questions about coverage for pre-existing conditions, named storms, or high-value items if these apply to your trip [4] .

- Make Your Purchase: Buy online directly from the insurer (such as Travel Guard’s secure site) or call their representative for guidance. For example, to purchase Travel Guard insurance, visit their official website or call 800-826-5248 for direct assistance [5] .

- Review and Confirm: After purchase, review your policy documents for accuracy. Most providers offer a 10-15 day ‘free look’ period to cancel for a full refund if you change your mind.

For destinations with special travel restrictions (such as Cuba), you may need to provide additional documentation and use paper applications. Always check the insurer’s requirements for your destination [5] .

Types of Travel Insurance Policies

Several policy types cater to different travelers:

Source: insuremytrip.com

- Single-Trip Insurance: Ideal for one-time vacations or business trips. Coverage is based on your trip’s total cost and duration [1] .

- Multi-Trip/Annual Policies: Suitable for frequent travelers. Coverage limitations may apply to cancellation benefits, so review carefully.

- Specialized Add-Ons: Policies often allow you to add coverage for rental cars, high-value items, adventure sports, identity theft, or political evacuation [2] .

Choose a policy tailored to your travel style, destination, and risk profile for best results.

Challenges and Solutions in Buying Travel Insurance

Common challenges include understanding complex policy language, determining coverage adequacy, and avoiding last-minute exclusions. Solutions:

- Challenge: Policies may exclude coverage for named storms or pre-existing conditions purchased after certain deadlines.

- Solution: Buy insurance as soon as you book your trip. If traveling to hurricane-prone areas, purchase coverage before storms are named [4] .

- Challenge: Overlapping coverage from credit cards or home insurance can cause confusion.

- Solution: Contact your card issuer or home insurer for a policy summary, and use travel insurance to fill any gaps, such as emergency evacuation or trip interruption.

- Challenge: Price comparison and benefit selection can be overwhelming.

- Solution: Use reputable comparison sites and seek guidance from insurer representatives if needed.

Alternatives and Additional Pathways

If you’re unable to purchase or afford traditional travel insurance, consider these alternatives:

Source: wisdomtimes.com

- Some credit cards offer limited travel insurance benefits (e.g., trip cancellation or lost luggage protection). Check your card’s benefits to see what’s included [1] .

- Homeowners or renters insurance may cover loss or theft of personal property while traveling. Call your insurer to clarify coverage and consider purchasing a rider for expensive items [4] .

- For medical emergencies abroad, some health insurers offer add-on international coverage. Contact your provider for details.

If you require further assistance, contact the National Association of Insurance Commissioners (NAIC) for consumer resources, or consult a licensed insurance broker for personalized guidance.

Key Takeaways

Travel insurance protects your trip investment, health, and peace of mind. Assess your risks, compare coverage, and buy early for maximum protection. Read all documentation and clarify questions before purchase. For direct assistance, contact reputable providers like Travel Guard at 800-826-5248 or visit their official website for secure online purchase [5] .

References

- [1] NerdWallet (2024). How to Find the Best Travel Insurance.

- [2] Rick Steves (2025). Do I Need Travel Insurance?

- [3] Allianz Travel Insurance (2020). The Complete Guide to Travel Insurance.

- [4] District of Columbia Department of Insurance, Securities and Banking (2004). Information About Travel Insurance You Should Know Before You Hit the Road.

- [5] Travel Guard (2025). Travel Insurance Plans | International.

MORE FROM oncecoupon.com