The Technology Behind Tap‑to‑Pay: How NFC and RFID Enable Contactless Transactions

Executive Summary: The Technology Powering Contactless Payments

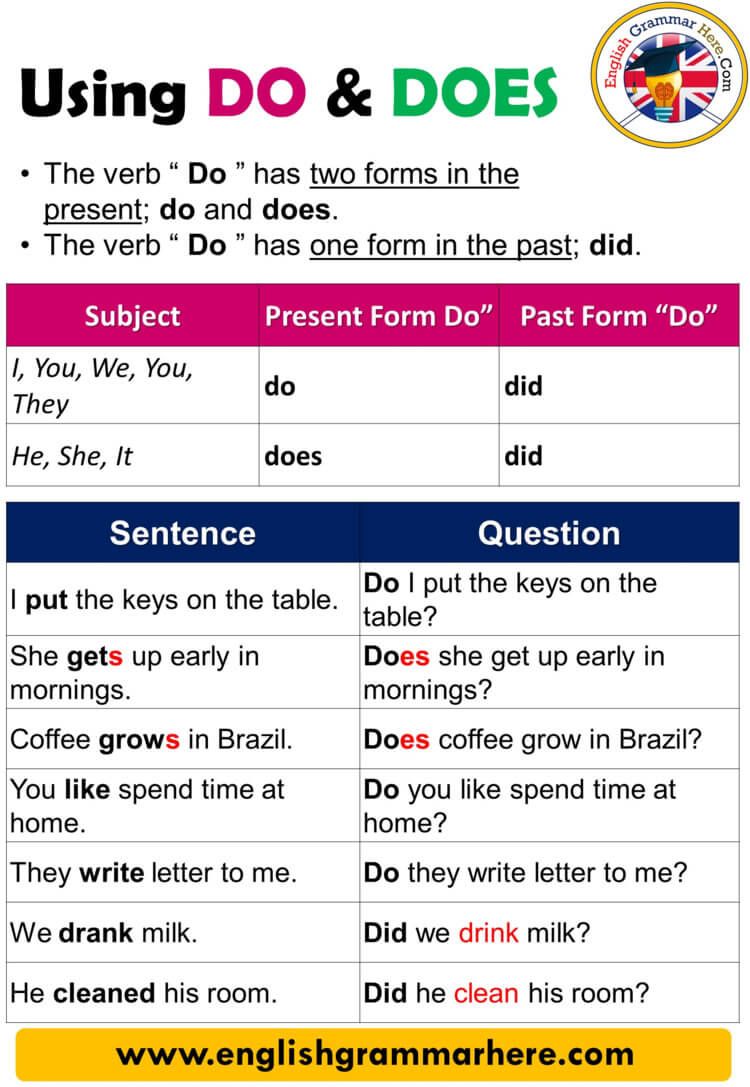

The primary technologies that enable modern contactless payment transactions are near-field communication (NFC) and radio-frequency identification (RFID) . These short-range wireless technologies allow cards, phones, and wearables to exchange payment data securely with a compatible point-of-sale (POS) reader when held a few centimeters away [1] [5] . NFC is the dominant standard used by mobile wallets (e.g., Apple Pay, Google Pay) and tap‑to‑pay cards, while RFID broadly describes the radio protocol family that includes NFC for proximity payments [1] [3] .

How Contactless Technology Works

Contactless transactions occur when a payment device communicates with a POS reader over a very short distance using electromagnetic fields. An embedded chip and antenna in the card or device energize and exchange data with the terminal only when in close proximity, typically within a few centimeters. This process leverages

NFC

(a subset of RFID designed for close range), enabling a fast, convenient “tap” experience without swiping or inserting a chip

[5]

[1]

. Mobile wallets use NFC in

card emulation

mode, allowing a smartphone or wearable to behave like a contactless card

[2]

.

Key Components

- Payment device: Contactless card, smartphone, smartwatch, or wearable with an NFC/RFID antenna and secure element or tokenization capability [3] [5] .

- POS reader: A terminal with the contactless symbol and an integrated NFC reader that powers, detects, and exchanges data with the device [1] .

- Network and issuer systems: Transactions are authorized over payment networks using EMV contactless specifications and security controls such as tokenization and cryptograms [5] .

NFC vs. RFID: What’s the Difference?

RFID refers to the broader class of radio-frequency identification systems, while NFC is a specialized, short-range subset optimized for two-way communication at the POS. In payments, NFC’s very close operating range helps reduce interference and supports secure protocols suitable for consumer transactions. Both terms appear in consumer explanations of contactless, but NFC is the prevalent implementation for tap‑to‑pay and mobile wallets [1] [4] [3] .

Types of Contactless Payments Enabled by NFC/RFID

1) Tap‑to‑Pay Cards

Contactless credit and debit cards embed a chip and antenna that communicate with a reader when tapped or held nearby. They are identified by the contactless symbol and typically do not require a PIN for lower-value purchases, depending on issuer and region policies. Major networks and issuers widely support contactless cards, making them a straightforward entry point for consumers and merchants [1] [3] .

Implementation steps: Merchants can enable acceptance by using a POS or reader with NFC capability, ensuring terminal software supports EMV contactless, and training staff to prompt customers to tap at the symbol. Consumers can request a contactless-enabled card from their issuer and look for the symbol at checkout [1] .

2) Mobile Wallets (Phones and Wearables)

Mobile wallets such as Apple Pay and Google Pay use NFC card emulation to transmit a

payment token

rather than the primary account number, adding a layer of security. Devices often require biometric or passcode authentication before a tap, combining convenience with strong user verification. Many wearables (e.g., smartwatches) leverage the same underlying NFC technology for quick wrist taps at compatible terminals

[5]

[2]

[3]

.

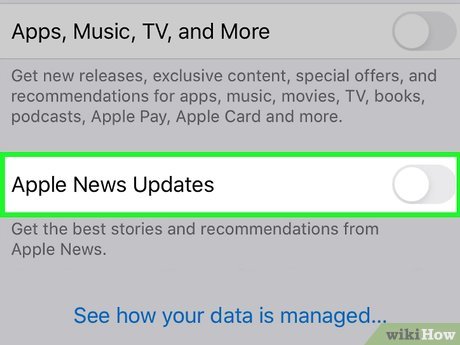

Implementation steps: Consumers can add eligible cards to their device wallet and enable authentication. Merchants confirm their terminals are NFC-enabled and display the contactless symbol. Staff training should cover positioning the device near the contactless target and confirming wallet activation prompts on the customer’s device [1] .

3) QR Code Payments (Alternative Approach)

Some contactless experiences use QR codes , where a consumer app displays or scans a code to initiate payment. While QR relies on optical scanning rather than radio, many retailers treat it as a “no-touch” alternative that complements NFC acceptance. It can be implemented in parallel for customers without NFC-capable cards or devices [1] .

Security Foundations: Why Contactless Is Designed to Be Safe

Contactless systems leverage multiple safeguards. NFC’s extremely short range limits exposure. EMV contactless protocols support dynamic cryptograms, and mobile wallets commonly use tokenization -substituting a device-specific token for the actual card number-plus biometric or passcode authentication on the device. These layers help mitigate cloning, skimming, and replay attacks in day‑to‑day retail scenarios [5] [2] .

Practical Risk Management

- For merchants: Keep terminals updated, enable EMV contactless configuration, and set appropriate thresholds for signature/PIN exceptions per network rules. Educate staff to recognize the contactless symbol and to guide customers to tap once, then wait for confirmation [1] .

- For consumers: Use device locks, biometrics, and wallet notifications. Consider wallet tokenization for additional protection, and monitor statements routinely. If unsure about NFC acceptance, you can ask the cashier if they support tap‑to‑pay at the contactless symbol [5] .

Step‑by‑Step: How Merchants Can Enable Contactless Acceptance

- Assess your POS hardware: Confirm your terminal or reader explicitly supports NFC/contactless and displays the contactless symbol. If unsure, consult your payment provider’s official documentation or support channel. Many modern terminals ship with NFC enabled by default [1] .

- Update software and configurations: Ensure the POS is running current firmware that supports EMV contactless kernels and network settings. You may need to enable specific tender types for contactless cards and mobile wallets [5] .

- Train staff for user experience: Provide a brief script: “When prompted, hold your card or phone near the contactless symbol until you hear a beep or see a checkmark.” Encourage staff to avoid repeated taps which can cause duplicate attempts [1] .

- Test across device types: Verify transactions with a contactless card, Apple Pay/Google Pay on a phone, and a smartwatch. If you also support QR, post clear signage to guide customers to the appropriate flow [3] .

- Monitor and optimize: Track tap‑to‑pay adoption rates, checkout time reductions, and decline reasons. Consider adjusting prompts or placement of the terminal to improve first‑tap success rates [2] .

Step‑by‑Step: How Consumers Can Start Using Contactless

- Check your card: Look for the contactless symbol on your debit or credit card. If it’s missing, you can request a contactless-enabled card from your issuer. Many issuers now provide this as a standard feature [1] .

- Set up a mobile wallet: Add your eligible card to your device’s wallet. You can then authenticate with a passcode or biometrics and tap at terminals displaying the contactless mark. Wearables often share the same wallet setup flow via the companion app [5] .

- Use at checkout: When the terminal is ready, hold your card, phone, or watch near the symbol until you get a confirmation beep, vibration, or on‑screen check. For higher amounts, your issuer or region may require additional authentication, which you can complete on‑device or via PIN where applicable [3] .

- Stay secure: Keep device locks active, enable transaction alerts, and review statements. If a card or device is lost, contact your issuer and, for mobile wallets, suspend or remove the tokenized card from the wallet settings [5] .

Real‑World Examples and Use Cases

Retail and quick‑service: Tap‑to‑pay speeds lines and reduces handling at busy counters. Many chains and independent retailers now advertise support via the contactless symbol at the reader [1] .

Transit and access: Transit systems around the world have long used contactless smart cards and increasingly accept open-loop contactless bank cards and mobile wallets for gates and validators. The same underlying NFC/RFID principles apply, reinforcing user familiarity with tap interactions [5] .

Events and venues: Wearables and mobile wallets streamline concessions and merchandise lines, minimizing cash handling. Contactless can reduce friction during peak demand periods, improving throughput and customer satisfaction [2] .

Challenges and Practical Solutions

Device compatibility: Not every older terminal supports NFC; upgrading hardware may be required. Solution: Merchants can plan phased upgrades, starting with the highest-traffic lanes, and retain chip-and-PIN as a fallback during transition [3] .

Source: freepik.com

User education: Multiple taps or removing the device too quickly can cause declines or duplicates. Solution: Clear prompts and staff coaching reduce errors. Posting a small sign at the POS that says “Tap here” with the symbol helps guide customers [1] .

Source: freepik.com

Security perceptions: Some users may worry about “drive‑by” charges. Solution: Emphasize short range, tokenization for mobile wallets, and dynamic cryptography in EMV contactless, plus the ability to lock cards/devices. Encourage alerts for every purchase to increase confidence [5] [2] .

Key Takeaways

- Core technology: NFC (a subset of RFID) enables secure, short‑range data exchange that powers tap‑to‑pay cards, phones, and wearables [1] [5] .

- Security: Tokenization, device authentication, and EMV cryptograms help protect data and reduce fraud risk in everyday use [5] [2] .

- Adoption path: Both merchants and consumers can enable contactless quickly by using NFC-capable terminals and wallets, supported by simple process training and signage [3] [1] .

References

[1] NerdWallet (2024). Contactless payments overview: how they work, types, and symbols.

[2] Stax Payments (2025). Contactless payment methods and NFC modes explained.

[3] Les Roches (2024). Demystifying contactless payments: cards, wallets, and wearables.

[4] Indeed (2025). What is contactless payment? Types, how it works, and benefits.

[5] Wikipedia. Contactless payment: definition, technologies (RFID/NFC), and EMV context.

MORE FROM oncecoupon.com