Understanding CSI in Automotive: The Key to Customer Satisfaction and Dealership Success

Introduction: The Critical Role of CSI in Automotive

In the modern automotive sector, CSI -the Customer Satisfaction Index -is more than just a number. It’s a vital metric that gauges how well dealerships and manufacturers meet or exceed customer expectations during vehicle purchases and service experiences. CSI not only influences brand reputation and customer retention, but also directly impacts dealership rewards, inventory allocation, and long-term growth [1] . Understanding, tracking, and improving CSI is essential for any automotive business aiming for sustained success.

What Is CSI in Automotive?

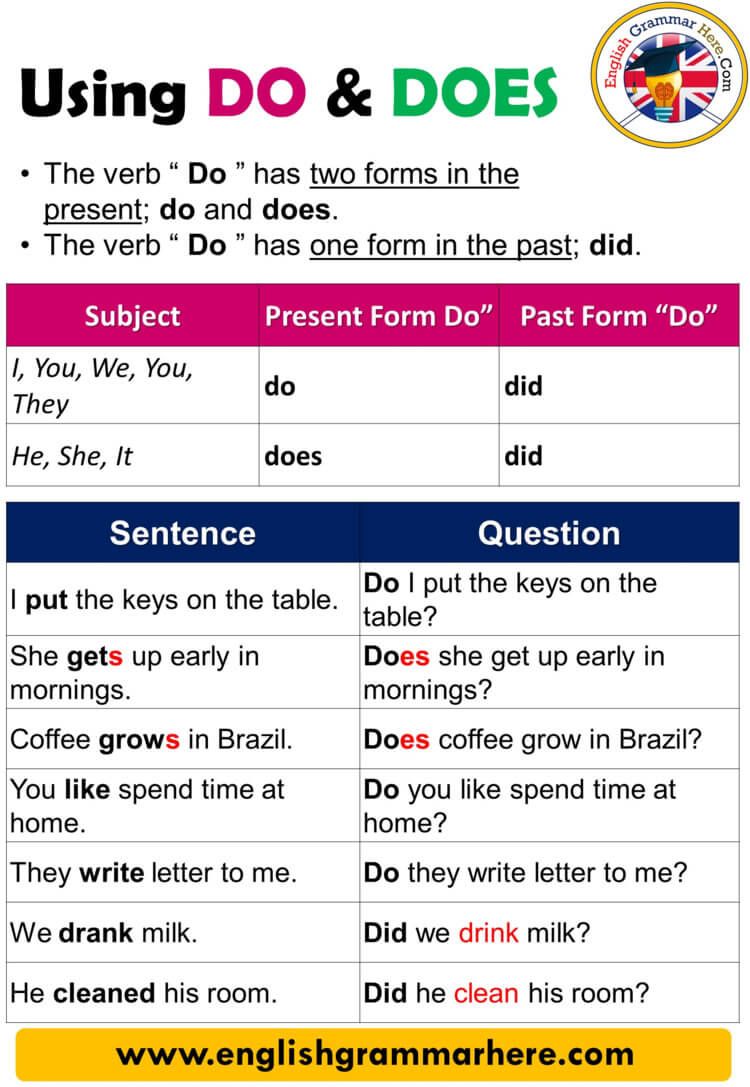

The Customer Satisfaction Index (CSI) is a standardized score that reflects the overall satisfaction of customers with their automotive experience. CSI is commonly calculated using feedback from post-sale or post-service surveys distributed by manufacturers (OEMs) or trusted third-party organizations such as J.D. Power [1] , [3] . Survey questions typically cover:

- Professionalism and friendliness of sales and service staff

- Clarity and transparency in the buying or servicing process

- Pricing transparency and trade-in values

- Follow-up communications after sales or service

- Likelihood to recommend or return

CSI scores are aggregated from these responses to provide a comprehensive view of dealership performance from the customer’s perspective [2] .

Why CSI Matters to Dealerships and Manufacturers

Automotive manufacturers use CSI scores to evaluate dealership performance, allocate desirable inventory, reward top performers, and identify areas needing additional support or training [1] . For dealerships, CSI acts as a performance compass, guiding hiring, training, and customer engagement strategies. A consistently high CSI score signals professionalism, efficiency, and a customer-first focus.

In many cases, CSI scores determine eligibility for quarterly OEM payouts and bonus programs. For example, a dealership with a CSI of 93 may receive significant financial incentives, whereas a score of 85 could mean thousands in lost revenue. Thus, CSI directly affects dealership profitability and competitiveness [1] .

How CSI Is Measured: Surveys and Scoring

CSI measurement relies on structured surveys sent to customers following a purchase or service visit. These surveys are typically managed by the vehicle manufacturer or reputable third-party organizations. Key survey areas include:

Source: wordpress.iloveimg.com

- Product quality and reliability

- Dealership facility condition and cleanliness

- Online and in-person experiences

- Pricing and overall perceived value

The index is calculated based on aggregated responses, often using an indexed scale (e.g., 0-100). Manufacturers may set specific targets or benchmarks for CSI scores, and top performers may be publicly recognized (such as in J.D. Power rankings) [3] .

Source: themoviedb.org

What Is a Good CSI Score?

While benchmarks vary by manufacturer and region, a CSI score above 90 is generally considered excellent in the automotive industry [5] . However, continuous improvement and exceeding customer expectations should be the priority. Dealerships are encouraged to track CSI trends and address any areas with declining scores promptly.

Some manufacturers set their own minimum acceptable CSI thresholds, and failing to meet these can result in inventory restrictions or loss of financial incentives. Therefore, maintaining a high CSI is both a strategic and operational imperative.

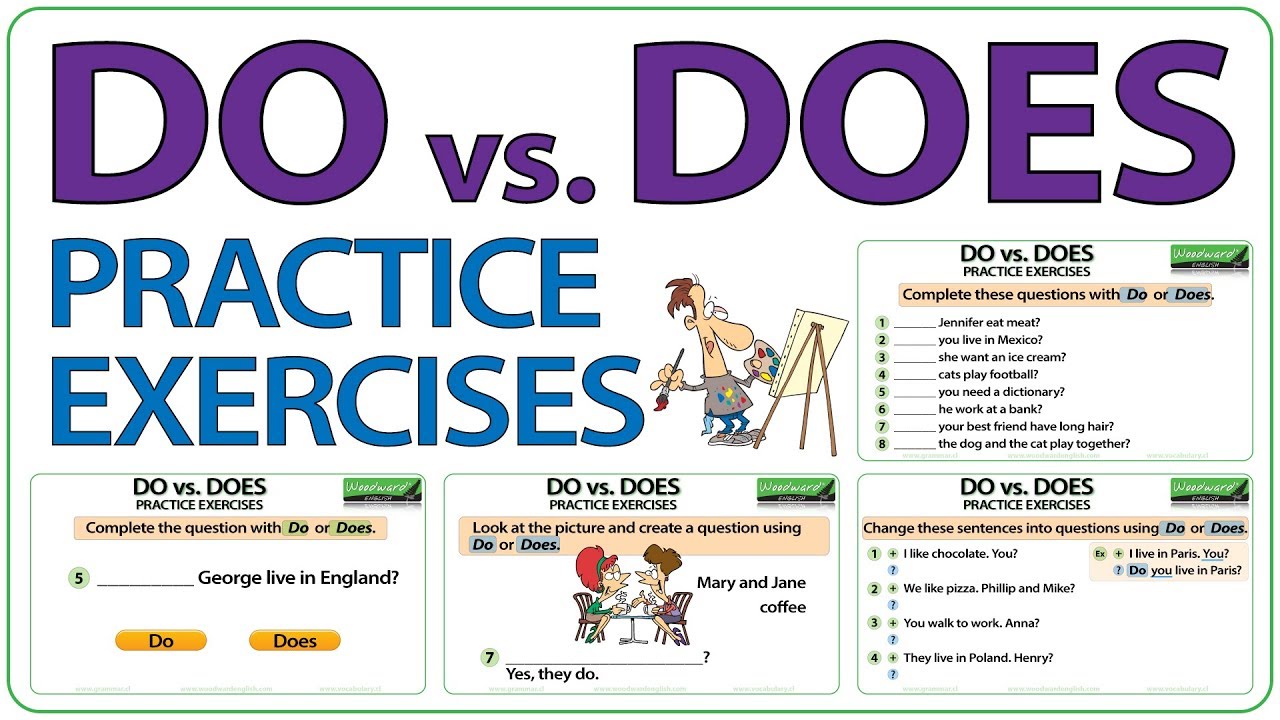

Actionable Strategies to Improve CSI

Improving CSI requires a comprehensive approach that addresses every aspect of the customer journey. Key strategies include:

- Staff Training and Development Invest in ongoing training programs for sales and service teams, focusing on communication, product knowledge, and customer engagement. Role-playing common scenarios and soliciting customer feedback can highlight areas for improvement.

- Process Transparency Ensure all pricing, trade-in values, and service recommendations are clearly explained. Customers value honesty and transparency, which directly boosts CSI scores.

- Facility Upgrades Maintain clean, welcoming dealership environments with modern amenities. Customers’ perceptions of the physical space often influence overall satisfaction.

- Follow-Up Communication Implement systematic follow-ups after sales and service visits. A simple thank-you call or email, along with reminders about future maintenance, can significantly increase customer loyalty and positive survey responses.

- Digital Engagement Utilize online appointment scheduling, live chat support, and digital survey tools to streamline customer interactions and gather actionable insights.

Each step should be tailored to your dealership’s unique customer base and local market conditions for maximum impact.

Real-World Example: Implementing CSI Improvements

Consider a mid-sized dealership that noticed declining CSI scores related to service wait times and communication. By investing in an online scheduling platform, retraining service advisors, and adding a comfortable waiting area with Wi-Fi and refreshments, the dealership saw its CSI score climb from 87 to 94 over two quarters. This improvement led to increased repeat business, positive reviews, and higher bonus payouts from the manufacturer [4] .

Step-by-Step Guidance for Dealerships

- Review Current CSI Data Collect and analyze recent survey results, identifying areas with low scores.

- Engage Your Team Present findings to staff, emphasizing the importance of CSI for business success and personal incentives.

- Set Improvement Goals Establish clear, achievable targets (e.g., raise CSI by 5 points in six months).

- Implement Targeted Initiatives Choose one or two areas for immediate improvement (e.g., faster service check-in, better pricing transparency).

- Monitor Progress Regularly track CSI survey results and adjust strategies as needed.

For dealerships seeking external help, consider consulting with third-party CSI experts or referencing studies such as the J.D. Power U.S. Customer Service Index (CSI) Study, which provides valuable industry benchmarks and best practices [3] .

Challenges and Solutions in Maintaining High CSI

Common challenges include inconsistent staff performance, unclear communication, and outdated facilities. To overcome these issues:

- Conduct regular staff training and performance reviews

- Standardize customer communication protocols

- Invest in facility upgrades where possible

- Solicit direct feedback from customers and act on it promptly

Dealerships may also face fluctuating CSI scores due to seasonal demand shifts or changes in customer demographics. Monitoring these trends and adapting strategies ensures long-term success.

Alternative Approaches to CSI Measurement

While manufacturer surveys are standard, dealerships can also deploy independent surveys or feedback tools. Some use digital platforms to collect real-time feedback via mobile apps or online portals. These methods provide more immediate insights, enabling faster response to issues and opportunities. Consider combining manufacturer CSI data with internal measurements for a 360-degree view of customer satisfaction [4] .

How to Access CSI Data and Resources

Dealerships typically receive CSI reports from their manufacturer partners, often via dedicated dealer portals or performance dashboards. For independent benchmarking, search for industry studies like the J.D. Power CSI Study or consult third-party firms specializing in automotive customer experience analysis. If you are a customer and wish to provide feedback, look for post-service surveys sent by your dealership or manufacturer via email or SMS, or request a feedback form at the dealership reception.

Key Takeaways for Automotive Businesses

- CSI is a vital indicator of dealership performance and customer loyalty.

- High CSI scores unlock financial incentives, better inventory, and stronger reputations.

- Continuous improvement, transparent communication, and facility investment are critical to maintaining and raising CSI.

- Dealerships should regularly analyze CSI data and act on customer feedback to stay competitive.

If you’re looking to improve CSI at your dealership, begin by reviewing your latest CSI reports, engaging your staff, and setting measurable goals. For industry-wide standards and best practices, consult studies from recognized organizations such as J.D. Power or reach out to your manufacturer’s dealer support team for resources and training opportunities.

References

- [1] TradePending (2025). A Complete Guide to CSI in Automotive for Car Dealers.

- [2] VentaVid (2025). CSI – Customer Satisfaction Index.

- [3] Invoca (2022). How to Boost Automotive Dealership CSI Scores with Conversation Intelligence.

- [4] Digital Dealership System (2024). CSI Car Dealership Tracking and Performance Reporting.

- [5] Covideo (2024). Automotive Tips and Tricks for Improving Your CSI Score.

MORE FROM oncecoupon.com